Carbon Border Adjustment Mechanism (CBAM) service

What is CBAM

CBAM (Carbon Border Adjustment Mechanism), is the EU’s trade policy tool to address climate change. The transition period (Oct 2023 – Dec 2025), during which reporting was required but no tariff applied, has ended. As of 1 January 2026, the definitive period has commenced, and CBAM costs are officially applicable.

Currently, CBAM covers six sectors: cement, aluminium, fertilisers, iron and steel, chemicals (hydrogen), and electricity. Whether an export product is subject to CBAM is determined by its CN code.

Furthermore, the European Commission also proposes extending CBAM to downstream products, planning to include 180 steel- and aluminium-intensive products, such as machinery and parts, automotive components, household appliances, electrical equipment, and metal products. This expansion is expected to take effect on 1 January 2028.

Carbon Newture supports companies with CBAM reporting, calculations, and other compliance services, helping ensure smooth participation in green trade.

CBAM requirements

1 Jan 2026

Start of the CBAM definitive period, but companies do not need to purchase or surrender certificates during 2026.

31 Mar 2026

Deadline for authorised declarants to apply (EU importers).

1 Sep 2026

Deadline for importers to finalize their 'Authorised CBAM Declarant' status application.

1 Feb 2027

Companies can purchase the first batch of CBAM certificates via the central platform to settle 2026 CBAM cost.

30 Sep 2027

Deadline for the first surrender of CBAM certificates; late surrender may incur penalties.

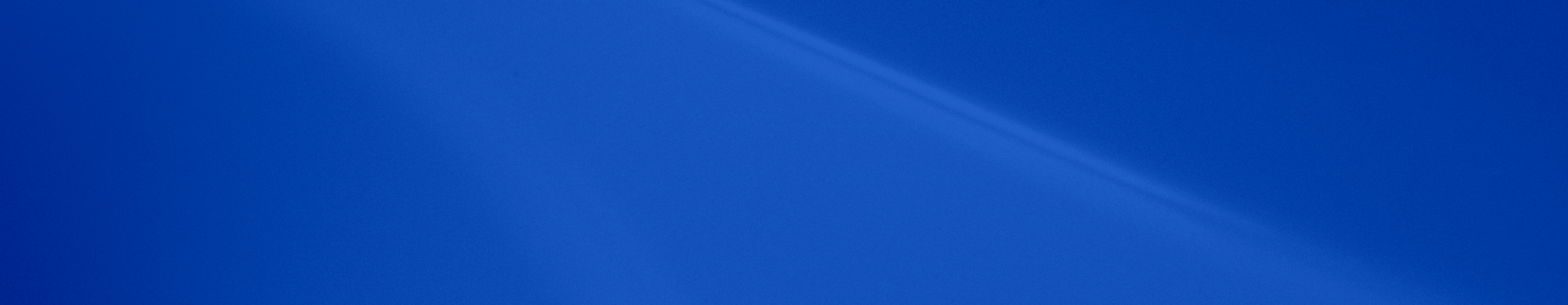

How CBAM taxes are calculated

CBAM cost calculation is straightforward in principle, but the final product CBAM cost is dynamic, influenced by multiple factors: EU ETS changes (phasing out of free allowances, cross-sectoral correction factor), CBAM certificate price fluctuations, and review adjustments of default and benchmark values.

Challenges you may face

Difficult reporting

Numerous forms in English, complex carbon calculations, and challenging professional terminology.

High costs

Gathering extensive data requires significant time and labor costs.

Data gaps

Upstream data gaps force the use of default values with mark-up, leading to higher costs.

Risk

Reporting inaccurately can lead to additional tax burdens as it directly relates to future CBAM tax payments.

What we provide

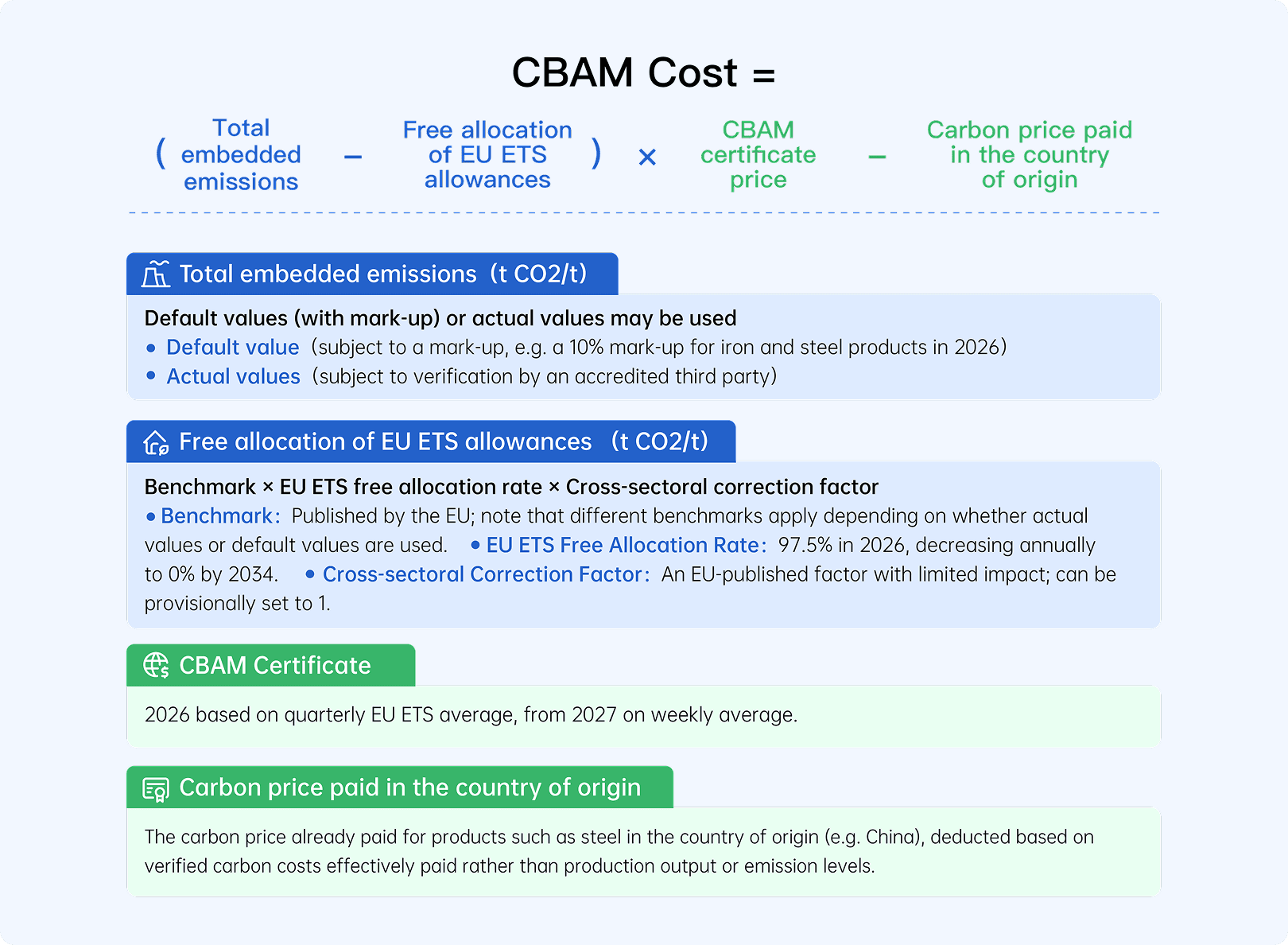

Supply Chain Management Platform: Assisting with internal data collection and upstream data communication

Establishing a carbon emission database to effectively mitigate risks arising from the lack of data (such as high CBAM taxes due to using only estimated values in the absence of actual data).

Helping you efficiently manage carbon data within the enterprise, bridging the gap in supply chain carbon data and overcoming trade barriers.

Actively address green trade barriers to ensure the secure and compliant flow of carbon data

Complete CBAM reporting with actual values to avoid fines for non-compliance or additional carbon taxes due to the use of inappropriate estimation values.

Assist you in building a CBAM carbon database to achieve compliant and efficient CBAM reporting.

Our advantages

Cost-Effectiveness

Efficiency

Authority

Standards we follow

Environmental management — Life cycle assessment — Principles and framework

Environmental management - Life cycle assessment - Requirements and guidelines

Greenhouse gases - Carbon footprint of products - Requirements and guidelines for quantification

Greenhouse gases: Specification with guidance at the organization or project level for quantification and reporting of greenhouse gas emissions and removals

Requirements and Guidelines for Quantifying the Carbon Footprint of Products in Terms of Greenhouse Gas Emissions

General guideline of the greenhouse gas emissions accounting and reporting for industrial enterprises

Requirements of the greenhouse gas emission accounting and reporting—Part 7: Flat glass enterprise

Requirements of the greenhouse gas emissions accounting and reporting —Part 10: Chemical production enterprise

Requirements of the greenhouse gas emissions accounting and reporting—Part 12:Textile and garment enterprise

Empower brands to enhance their green value

helping enterprises successfully create ”Carbon Neutrality“ IP and a new brand image

The Steel And Iron Industry

Shanghai Foreign Trade (Pudong): Obtains TÜV SÜD conformity assessment report